In July, Jefferies’ Private Capital Advisory team released its mid-year review of the secondary market, consolidating discussions, surveys, and research from the market’s biggest and most influential limited partners, general partners, and secondary buyers.

This report follows Jefferies’ H2 2023 secondary market review, which predicted near-record secondary volume, higher LP pricing, and a sustained capital overhang for fiscal year 2024. The latest findings show the first half of the year largely met these expectations.

Here, Jefferies Insights shares high-level takeaways from the Private Capital Advisory team.

It’s shaping up to be a banner year for the secondary market.

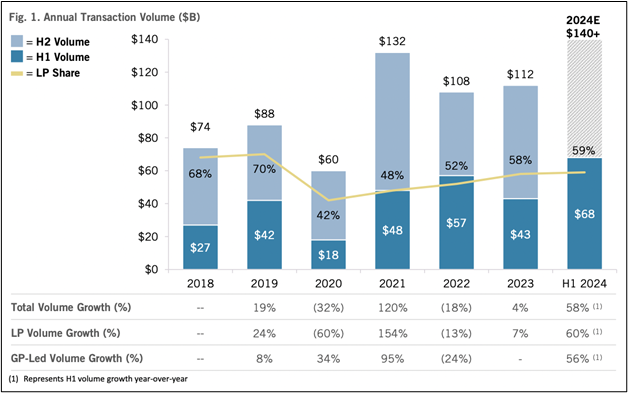

Global secondary volume hit a record $68 billion in H1 2024, driven by near-peak dedicated secondary capital dry powder, a surge in well-capitalized new entrants, increased demand from ’40 Act funds fueled by retail capital inflows, and a supportive macroeconomic and valuation environment over the first half of the year.

Jefferies original (H2 2023) and revised (H1 2024) expectations for the secondary market.

Key First Half Themes

Liquidity Demands Drive Record First-Half Volume

The first half of 2024 saw record-breaking secondary market volume, surpassing the previous record of $57 billion set in the first half of 2022. Activity was robust as limited partners (LPs) sought liquidity across their portfolios, bringing larger and more diversified transactions to market. General partner (GP)-led volume also grew as a function of robust demand for continuation funds by investors and continued adoption of the structure from sponsors desiring to generate liquidity for their LPs and hold attractive companies for longer.

Jefferies expects these trends to continue in H2 2024.

LP Portfolio Pricing Climbs Higher

The average high bid for all strategies was 88% of net asset value (NAV), a 300-basis point increase from the second half of 2023. Pricing for LP portfolios steadily improved throughout the first half of 2024, driven by expectations of near-term interest rate cuts, strong portfolio performance, and a gradually improving exit environment. Both newer vintage funds and older tail-end funds saw price increases as buyers showed strong demand for diversified exposures.

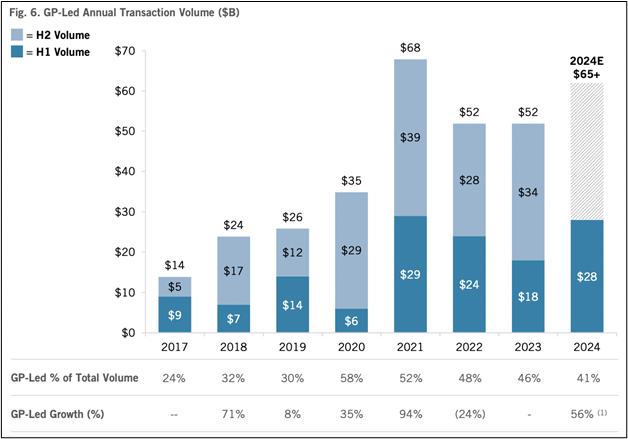

Buyside Demand Catalyzes GP-Led Volume Growth

GP-led activity in the first half of 2024 continued to benefit from the momentum in the second half of 2023. On a last twelve months (LTM) basis, GP-led volume reached $62 billion, marking one of the highest periods of sustained activity since the inception of the GP-led secondary market. Continuation funds comprised 14% of global sponsor-backed exit volume in H1 2024, up from 11% in 2023. As continuation funds have become mainstream in private equity and expanded into other segments of the private markets, well-capitalized secondary investors are eager to partner with a range of sponsors on these deals.

Jefferies expects continued momentum in the GP-led market.

Record Levels of Available Capital

At the end of the first half of 2024, dedicated available capital, including near-term fundraising, was estimated at $253 billion. This was nearly unchanged from 2023. Record fundraising, combined with the emergence of increasingly active and sizeable ’40 Act funds raising capital from retail channels, supports a well-capitalized buyside heading into the second half of 2024.

What To Expect in H2 2024

Looking ahead to the second half of 2024, Jefferies forecasts record annual transaction volume exceeding $140 billion by year-end. Growth will be driven by increasing transaction supply, robust secondary pricing, and anticipated interest rate cuts that could boost further growth and equity returns.

Jefferies expects sustained LP-led transaction volume near $40 billion, with GP-led transactions rising to over $35 billion. LP portfolio pricing is anticipated to continue climbing, potentially exceeding 90% of NAV in the second half of 2024 — levels not seen since 2021 — barring any sustained period of public markets volatility.

Additionally, the continued emergence of ’40 Act funds and other alternative capital pools is expected to further drive demand for secondary transactions and maintain dedicated available capital despite significant deployment from traditional secondary funds.

For Jefferies’ full H1 2024 review of the global secondary market, click here.